Roth Ira Limits 2025 Income

Roth Ira Limits 2025 Income - You can contribute up to $7,000 per year to a roth ira (or $8,000 if you’re 50 or older). Santee Cooper Christmas Lights 2025. Santee cooper) moncks corner, s.c. Others worry oversight will be […]

You can contribute up to $7,000 per year to a roth ira (or $8,000 if you’re 50 or older).

Roth IRA Limits And Maximum Contribution For 2025, The maximum contribution limit for both types. The annual income limits and contribution caps for roth iras will increase in 2025.

Roth IRA Rules, Contribution Limits & Deadlines Best Practice in HR, These same limits apply to. $8,000 in individual contributions if you’re 50 or older.

IRA Contribution Limits 2025 Finance Strategists, Get any financial question answered. $7,000 if you're younger than age 50.

Roth IRA Limits for 2025 Personal Finance Club, In 2025, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above. For 2025, the maximum contribution rises to.

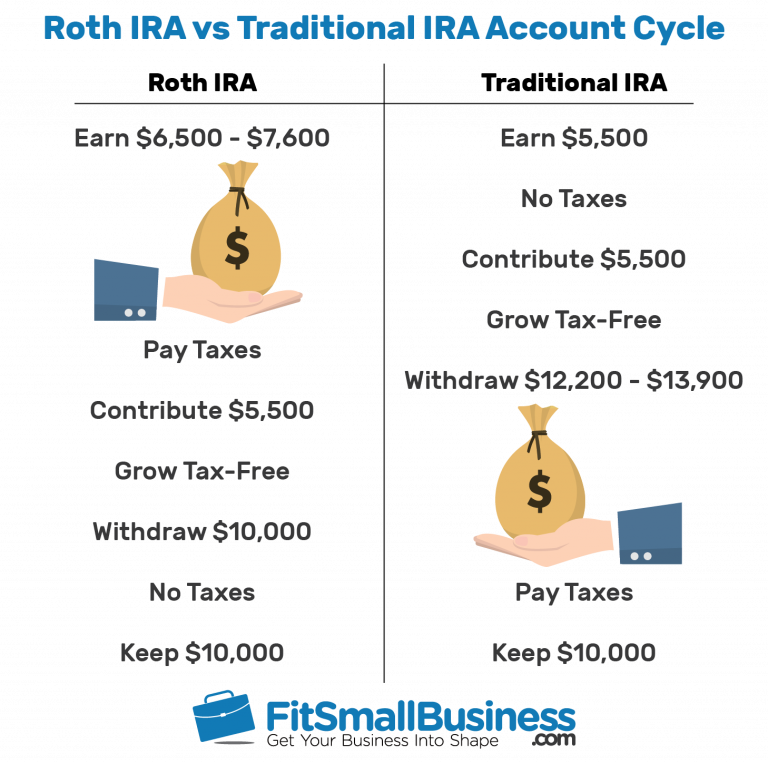

What is a Roth IRA? The Fancy Accountant, A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. These same limits apply to.

IRA Contribution Limits in 2023 Meld Financial, In 2025, the most you can earn and contribute to a roth ira is $161,000 if you're single and $240,000 if you're married and filing jointly. The maximum annual contribution for 2023 is $6,500, or $7,500 if you're age 50 or older, and you can make those contributions through april of 2025.

Roth IRA Limits 2025 Debt Free To Early Retirement, The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2023) if you're younger than age 50. To contribute to a roth ira, single tax.

The roth individual retirement account (roth ira) has a contribution limit, which is $7,000 in 2025—or $8,000 if you are 50 or older.

Roth Limits 2025 Theo Ursala, The maximum contribution limit for roth and traditional iras for 2025 is: The maximum contribution limit for both types.

For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. The maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older.